Usury has been around since the beginnings of civilization, and it is something that either you understand or you don’t. Simply put, usury is the charging of excessive interest on a debt. Let us say that you have the relatively small amount of $3,500 worth of credit card debt, upon which you are being charged the not-uncommon rate of 29 percent interest per year (APR), and your minimum payment is set at say $85 per month. Thanks to the nature of compound interest, it will take you 194 months to pay off the debt, meaning that, by the end of it — 16 years later — you will have paid $16,490 on the original loan. The interesting thing is that there is a magic minimum payment number that, if you go below it, the number of months that it will take to pay off the debt will become infinite. The closer you get to the number, the longer it takes to pay off, and the more money the lender makes. Therefore, consider this. If your minimum payment is dropped down a mere quarter to $84.75, the number of payments increases to 261, and the total amount paid to $22,120. You can readily see where things are headed here. (Note for those not bored by math: The effect of compounding on debt can be calculated by anyone who googles “amortization calculator,” which applies the underlying equation M = P(1+r)n r / [(1+r)n-1], where M is monthly payments; P is the principal; r is the interest rate; and n is the number of payments.)

When the Roman statesman Cato was asked what he thought of usury, he replied: “What do you think of murder?”

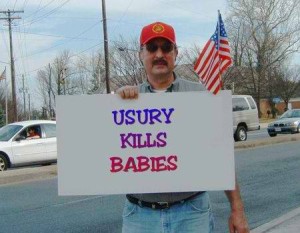

this man is not a celebrity, but perhaps he should be

Interestingly, amortization comes from the Latin word for death, and a moment’s reflection can see how the practice of usury can push one towards death. By messing with the numbers, one can generate large payments over time off of a relatively small debt. In my mid-20s, I remember feeling trapped and suffocated by $5,500 worth of credit card debt. Not knowing where to turn, in a moment of desperation I responded to a television ad, and, luckily, reached a legitimate debt relief agency. The debt counselor told me that if I continued making the minimum payments, I would be paying for 20 years, and I would pay over $50,000 on my original loan. It is easy to see how the nature of the loan could have taken away any chance of retirement, owning a house, marriage, a family, a dignified life.

Like many, I had fallen victim to credit card company marketing. As a typical college student living on a shoestring budget, credit card offers from Citibank and Discover magically appeared in my mailbox. Initially, I didn’t pull the trigger on the offers, until the winter after I had graduated. Unemployed, hopeless, and living with a girlfriend in Washington state, I was seeking escape. The mountains were calling me, and I wanted to take up snowboarding. That was the start of it. I wondered how these credit card companies came to know of my existence. What are the ethics of this sort of advertising? Had I known that the cards would not be payed off until I was 30, after years in a debt relief program, I might have thought twice. It was something that my father, an electrical engineer, had warned me of.

A recent survey here on Typewriter People highlighted the fact that Americans are bombarded by advertising from banks and credit card companies. About 24 times as much money is spent annually to advertise to us about financial products and services than is spent to educate us about the dangers of perpetual debt. The several hundred million spent by mostly non-profit groups on consumer financial education is dwarfed by the $17 billion spent by banks. Regardless of what is in your wallet, Capital One has Jimmy Fallon, Alec Baldwin, and Samuel Jackson in theirs.

The Jimmy Fallon ads feature Fallon going toe to toe with a baby in his typical not-funny way, one of which can be seen here.

Alec Baldwin’s ad, which is predictably for an airline rewards card can be seen here.

Samuel Jackson’s ad for a cash back points earning card can be seen here.

Considering the fact that many blame banks for the financial crash of 2008 and recession from-which we are still attempting to recover, one might expect some backlash against these celebrities for their endorsement of credit cards and shilling for large banks. Ironically, the only backlash I could find was against Samuel Jackson’s ad. Apparently the organization 100 Million Moms, a branch of the conservative media watchdog group American Family Association, took offense to Jackson’s use of the word “damn” in the phrase “every damn day,” referring to the “cash back” being offered by the credit card company. This is like saying it is okay to sell young people on these dangerous financial products that they often only marginally understand, but be polite while doing it. All of this leads to the question: Should we demand more from our celebrities and the ways they exercise their fame to influence many and enrich a few? Granted, if one celeb turns down an offer, there will be another there to take his or her place. At the same time, anyone who has been to a foreign country knows that, ever image conscious, even A-List celebrities regularly appear in commercials advertising things overseas that they would not advertise in America. Considering this, the credit card companies must be paying a premium to have celebrities appear in ads for American audiences.

Celebrity in America is as transient as the latest fad, leaving famous people, for all their ability to influence the public mind, hyper-vigilant when it comes to anything that could diminish their standing. The fact that rich, world-famous performers feel comfortable taking money to sell credit cards says more about our lack of anger or understanding regarding perpetual debt, than it does about the celebrities themselves. If we foster education about revolving debt and people understand what a terrible and dangerous threat credit card debt can become, we likely won’t see our biggest stars peddling them.

Note:

Celebrities appearing in credit card commercials is not a new phenomenon. A moment’s search or a good memory will bring to mind Jerry Seinfeld and Ellen Degeneres advertising for American Express, and, perhaps more obscurely, Pierce Brosnan and Kevin Bacon advertising the Visa check card, to-which Morgan Freeman has also lent his voice. Some of these ads can be seen here.